Fivetran–dbt Labs Acquisition: In the fast-changing world of cloud data and analytics, competition is fierce and partnerships are powerful. According to recent reports, Fivetran Inc., a global leader in automated data integration, is in advanced talks to acquire dbt Labs Inc., a specialist in analytics engineering and data transformation. The potential deal, valued at several billion dollars, could reshape how enterprises build and manage their modern data stacks.

Why This Acquisition Matters

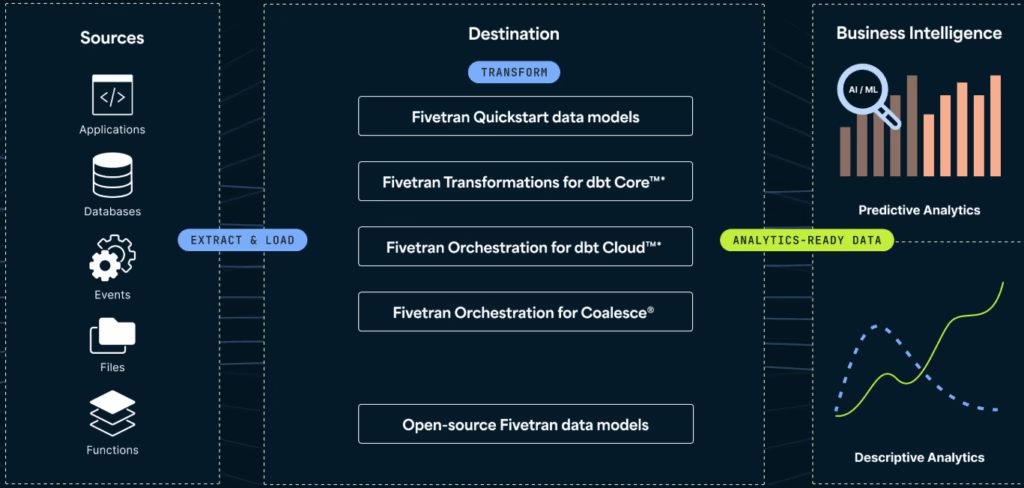

Fivetran has built its reputation by making data integration effortless, while dbt Labs has become the go-to platform for data transformation and analytics engineering. Together, the companies could offer enterprises a true end-to-end solution—from extracting and loading data to preparing it for advanced analytics and AI.

The move builds on their existing partnership, including Fivetran-dbt Cloud orchestration launched in early 2024. More than 1,000 mutual customers already benefit from these integrations, streamlining their pipelines and accelerating insights. A merger would take this further, creating a unified platform at a time when businesses demand seamless, AI-ready data workflows.

Growth Through Strategic Acquisitions

Both companies have expanded through high-profile acquisitions:

- Fivetran (valued at $5.6B in 2021) has snapped up HVR ($700M for real-time replication), Census (for reverse ETL), and Tobiko Data (for open-source transformation tools).

- dbt Labs, valued at $4.2B in its last funding round, added Transform in 2023 to enhance semantic and contextual analytics.

This merger would combine Fivetran’s strengths in data movement with dbt’s transformation expertise, reducing fragmentation in enterprise data pipelines.

The Valuation Dynamics

Valuation is at the heart of this deal. Dbt Labs once aimed for a $6B raise but settled at $4.2B amid market shifts. If Fivetran offers a premium now, it reflects both confidence in dbt’s technology and the loyalty of its fast-growing user community.

Still, the companies face competition from industry giants like Snowflake and Databricks, which have invested in dbt Labs. The outcome of these talks could determine how the next generation of data infrastructure is shaped.

What It Means for Enterprises

For enterprise data strategies, this deal could deliver:

- Simplified modern data stacks with fewer integration points.

- Faster analytics and AI adoption by reducing delays between data movement and transformation.

- Global scalability as dbt Labs gains resources to compete head-to-head with larger rivals.

In short, the merger could set a new standard for cloud data pipelines—from raw ingestion to business-ready insights.

Looking Ahead

Negotiations are ongoing, and factors like regulatory review or rival bids could still influence the outcome. But one thing is clear: consolidation is accelerating in the data tools market, and businesses are placing a premium on platforms that combine reliability, integration, and transformation in one ecosystem.

As enterprises increasingly treat data as the new electricity, this potential Fivetran–dbt Labs acquisition underscores the value of integrated, AI-ready solutions for the future of analytics.

Also Read

Oracle’s Market Surge Highlights the Growing Influence of AI Trades

Pingback: TCS Partners With TPG in ₹18,000-Crore Push to Build India’s Next-Gen AI Data Centres - Tank Seekers