Artificial intelligence is no longer just a buzzword—it has become one of the most powerful drivers of stock market performance. The recent surge in Oracle’s market value illustrates how investor sentiment is increasingly tied to AI developments and how companies positioned within this ecosystem are being rewarded with heightened valuations.

Oracle’s Role in Cloud and AI

Oracle, once best known for its databases and enterprise software, has transformed itself into a significant player in the cloud computing and artificial intelligence race. Its investments in cloud infrastructure, machine learning platforms, and AI-driven analytics tools have positioned the company to capture a growing share of enterprise demand.

One of Oracle’s most compelling advantages is its integration of AI directly into its cloud services. By embedding machine learning in database management and enterprise applications, Oracle is making it easier for organizations to adopt AI without having to build complex systems from scratch. This strategy not only appeals to its long-standing customer base but also attracts new businesses seeking ready-to-use AI capabilities.

The company’s recent financial performance suggests that this pivot is paying off. Demand for AI-enabled cloud services is fueling revenue growth, which in turn has captured investor attention.

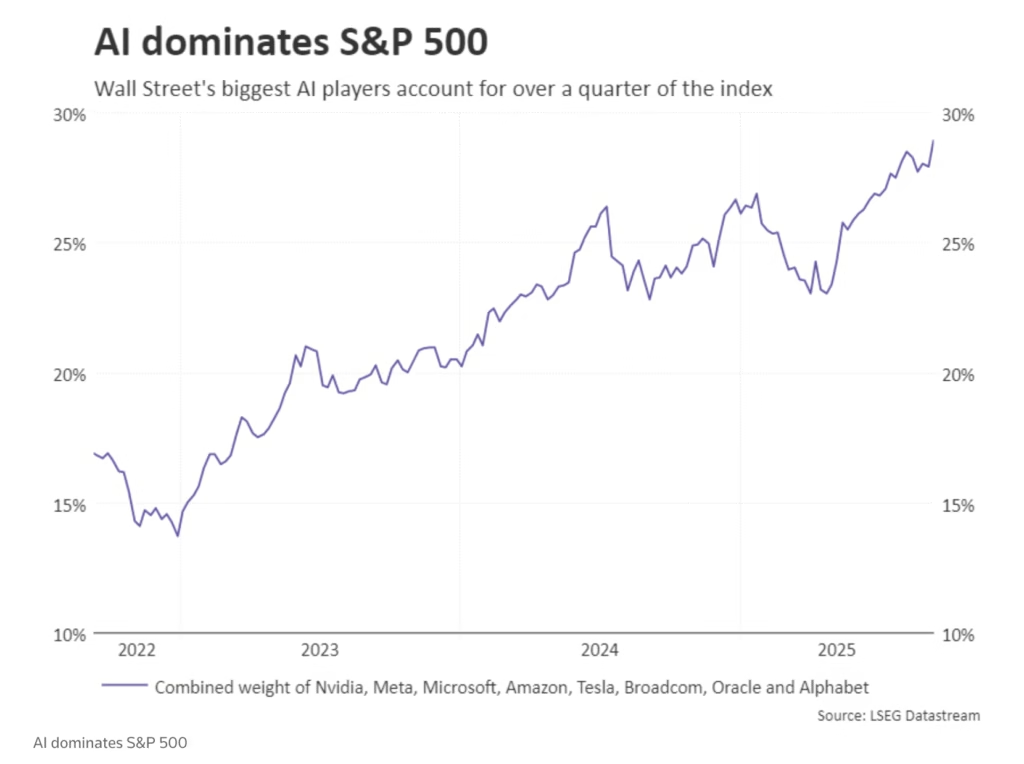

How AI Trades Influence Broader Indices

Oracle’s surge is part of a much larger trend in global equity markets. AI-related trades are no longer confined to individual stocks; they are reshaping entire indices. Technology-heavy benchmarks, such as the Nasdaq and S&P 500, have seen significant gains, largely due to the weight of companies leading in AI.

For investors, the narrative is straightforward: firms with AI exposure are likely to capture outsized growth opportunities. This has created a ripple effect across sectors. Even non-tech industries are being revalued based on their ability to adopt AI for efficiency, automation, and innovation.

As a result, AI has become a central factor in portfolio allocation strategies. Exchange-traded funds (ETFs) focused on AI are gaining traction, and institutional investors are recalibrating their positions to ensure they don’t miss out on the upside.

Investor Sentiment and Emerging Risks

Investor enthusiasm around AI is undeniably strong, but with it comes heightened risks. The rapid re-pricing of technology stocks raises questions about sustainability. Is the surge driven by fundamentals, or is it beginning to resemble past bubbles where expectations far outpaced reality?

For now, Oracle’s financial results and clear AI roadmap justify optimism. However, some analysts caution that not all companies branding themselves as AI leaders will deliver long-term value. Volatility is likely to remain high as markets try to separate genuine innovation from hype.

Moreover, regulatory uncertainties loom. Governments across the world are debating how to govern AI development and usage. Future regulations on data privacy, ethical AI, and cybersecurity could impact both adoption rates and profitability. Investors must weigh these risks alongside the growth potential.

Oracle vs. Tech Giants: Microsoft, Nvidia, Amazon

To fully understand Oracle’s rise, it is worth comparing it with other leaders in the AI race.

- Microsoft has embedded AI into its Office suite, Azure cloud, and search products, creating a massive ecosystem where productivity tools and AI converge. Its close partnership with OpenAI gives it a leading edge in generative AI.

- Nvidia, the undisputed leader in AI chips, has seen its market capitalization soar as demand for graphics processing units (GPUs) skyrockets. Its hardware is the backbone of many AI systems, making it central to the industry’s growth.

- Amazon continues to expand its AI footprint through AWS (Amazon Web Services), Alexa, and logistics automation. Its cloud dominance gives it an unrivaled platform to scale AI adoption globally.

While Oracle is not yet at the same scale as these giants, it benefits from its niche strength—offering AI-infused enterprise solutions that directly address corporate needs. This differentiation allows Oracle to carve out a profitable corner of the AI market without competing head-to-head with consumer-facing AI applications.

Future Outlook: AI as a Financial Market Driver

Looking ahead, AI is set to remain one of the defining themes in capital markets. The technology’s ability to unlock productivity gains, create new revenue streams, and transform industries ensures that investor interest will not fade anytime soon.

For Oracle, the challenge will be sustaining momentum by continuing to innovate and scale its AI offerings. Partnerships, acquisitions, and deeper integration of AI across its platforms could strengthen its competitive edge.

On a broader level, AI’s role in financial markets will likely deepen. As more companies demonstrate tangible business results from AI adoption, capital will flow even faster into the sector. However, the market will also become more selective, rewarding genuine innovation while penalizing overhyped promises.

In this landscape, Oracle’s surge is more than a one-off success story—it is a symbol of how artificial intelligence is rewriting the rules of investing. For traders, analysts, and everyday investors, the message is clear: AI is no longer a speculative theme; it is a structural force shaping the next decade of global markets.

Also Read: Interview Question: Explain Snowflake Architecture

Pingback: Fivetran–dbt Labs Acquisition: What the Potential Merger Means for Modern Data Stacks - Tank Seekers